Innovation is key to maintaining a top market position. But creating new technologies and commercializing scientific discoveries is neither fast nor cheap.

To help businesses, governments offer research and development tax credits — special deductions for research and innovation to offset income tax liabilities. For example, France offers a 30% tax credit (aka a discount) on R&D expenses up to €100 million. And until April 2024, the UK had a 186% super-deduction for qualified small businesses (now restored to 100%).

In the US, R&D tax incentives are available at the federal (through the IRS) and state (through your local Department of Revenue) levels.

The federal research & development tax credit (formally known as the Credit for Increasing Research Activities) allows companies to claim 6-10% of qualifying R&D expenses as a federal income tax deduction. You can receive up to $250K in payroll taxes if you meet eligibility criteria.

At the state level, New York offers an extra 10-20% R&D tax credits for local businesses, while Delaware refunds the difference between the company’s in-state tax liability and the total R&D tax credit given.

Naturally, the “offer” comes with some strings attached. Companies must provide the IRS with data on their R&D spend, including specifics about activity types, duration, and cost. Getting those numbers correct can be daunting, especially as the rules constantly change.

This guide answers all questions about the federal R&D tax credit, from eligibility and qualification to accurate reporting, in accordance with the latest rules and automated data collection tools.

TL;DR — Key Takeaways

- Federal R&D tax credit applies to qualified expenditures related to building new products, commercializing scientific findings, or investing money in other process enhancements.

- New requirements came into effect for the 2024 tax year (reported in 2025), and it’s important to stay updated on changes to maximize your credits.

- You must operate as a legally registered entity and perform research activities that pass a four-part qualification test to qualify for an R&D tax credit.

- Your gross receipts must not exceed $5 million to claim the R&D payroll tax credit.

- If you pass all four parts of the qualification test, you can claim a tax credit for qualified research expenses like employee salaries, research supplies, contracting expenses, software, and hardware costs.

- You must keep tangible proof of all your activities in case of an IRS audit. That’s the real challenge because many teams don’t use time-tracking tools, keep poor project documentation, or just don’t have an effective process for R&D reporting data collection.

- To streamline R&D tax reporting, embed a time-tracking tool into your workflows to automatically capture R&D-related work hours, tasks, and expenses.

- Toggl Track enables you to seamlessly capture qualified research activities and produce auditable logs for reporting. Boasting 100% user adoption, our time-tracking tool helps companies claim the maximum available tax credits.

What to know about the US R&D tax credit in 2025

The R&D tax credit was introduced in the Economic Recovery Tax Act of 1981 and was renewed and extended multiple times before becoming a permanent fixture of the Internal Revenue Code (IRC) in 2015.

Since then, R&D tax credit rules have changed significantly, but CPAs often recommend startups and small businesses apply for them (as they get the most perks!) Larger companies engaged in innovative work may also take advantage of the benefit to offset their tax burden.

Following the 2024 changes, here’s a recap of key US R&D tax credit changes in 2025 to look out for:

| In effect | Pending approvals |

|---|---|

| • Payroll tax credits are available to new and existing businesses, generating gross receipts of less than $5 million for the tax year or no gross receipts for any tax year before the preceding 5-tax-year period • Flow-through entities (like an S corporation or LLC, treated as a partnership for tax purposes) can also claim payroll tax deductions. • Updated Form 6765 requires businesses to provide more qualitative (not just quantitative) data about their research activities. • The new Section G is optional for 2024 tax returns (processing year 2025) but will become mandatory for tax year 2025 (processing year 2026) for everyone except qualified small businesses and taxpayers with lower qualified research expenses (QREs). | • Reversal of R&D expense amortization. Under the Tax Cuts and Jobs Act (TCJA), companies must spread R&D expenses over five years for domestic research and over 10 years for foreign research. A vote to repeal it didn’t pass Congress, but the new administration is keen to adopt it. • If it succeeds, businesses could claim domestic R&D expenses in the same year (including all R&D expenses amortized until 2022). However, amortization would still apply to all non-US R&D expenditures. • Employee Retention Credit (ERC). Introduced during the pandemic, ERC allowed businesses to claim substantial payroll tax credits. But it soon became a major fraud source, forcing the IRS to pause new ERC claims processing payouts on September 14, 2023. • Since then, the IRS hasn’t resumed ERC processing, causing a flurry of lawsuits and taxpayer complaints. The filing deadline for 2021 ERC claims is April 15, 2025 — and it’s still uncertain what the IRS will decide. |

It’s a mixed bag of changes. On the pro side, companies can now receive up to 20 cents in credits for every dollar spent on qualified research activities (QRAs). But Form 6765 has become more detailed and the IRS is stringent about auditing the submitted income tax returns.

Who qualifies for the R&D tax credit?

Technically, any type of business qualifies if it fits the requirements of legal structure, research activities, and revenue cap. This includes:

- All registered legal entities, including partnerships, S-corporations, LLCs, and corporations that qualify for the federal R&D tax credit.

- Businesses whose research relates to a product, process, software, technique, formula, or invention.

- Businesses whose qualified research activities aim to develop or enhance a qualitative or quantitative characteristic for the above (e.g., better functionality, durability, quality, or performance). These activities must be rooted in hard science or engineering principles to resolve existing technological uncertainty. Finally, the research process must be systemic (e.g., it must follow a logical, explainable flow).

- Small businesses generating under $10 million in gross receipts can also offset payroll taxes with the R&D credit.

Generally, it’s a good idea to apply if you run a business in tech (software and hardware), aerospace, biotech, pharmaceuticals, or green energy. In Connecticut, for example, manufacturing companies were top R&D tax credit recipients. Meanwhile, in California, many accounting services providers, apparel, automotive, beverage, and construction companies have also benefited.

How to pass the four-part test to qualify for the R&D tax credit

To get approved for an R&D tax credit, you must pass the four-part test defined by the IRC Section 41. The parts include a Business Component Test, Technological in Nature Test, Elimination of Uncertainty Test, and Process of Experimentation Test.

If you fail one segment, your claim won’t get approved. Here’s how to avoid that:

1. Business Component Test

Your research must clearly relate to a core aspect of your business — a workflow, operating procedure, software, or product. Its goal must be to produce a measurable improvement in its performance, functionality, or reliability, not just aesthetics.

| ✅ Qualifying activities | ❌ Non-qualifying activities |

|---|---|

| • Developing a more energy-efficient battery version • Building software for recruiting workflow optimization • Brewing a new beverage with 50% more nutrients | • Collecting customer data with no clear objectives • Purchasing and installing a new MarTech platform • Changing the product’s ergonomics and color palette |

💡 Tips for passing this stage:

- Document how the research objectives relate to your business operations

- State the key research hypothesis and their expected impacts

- Share tangible proofs like a patent application, solution blueprints, or software architecture

2. Technological in Nature Test

Your research activities must be rooted in hard sciences like engineering, chemistry, physics, or computer science. They can’t be purely based on arts, social, or humanities research.

| ✅ Qualifying activities | ❌ Non-qualifying activities |

|---|---|

| • Developing a reinforcement learning agent for autonomous driving • Creating new drug formulas using biotech research • Creating a new concrete formulation with higher tensile stress resistance | • Relying on user experience research to improve product interface • Hosting customer focus groups to validate a new product prototype • Using new typefaces and logos for packaging |

💡 Tips for passing this stage:

- Write a memo explaining which scientific principles the project involves

- Keep records of any simulations, models, and calculations

- Present a physical prototype or a digital model under development

3. Elimination of Uncertainty

You must demonstrate your project aims to resolve uncertainty about a product development or improvement — meaning you didn’t have a clear answer before starting.

| ✅ Qualifying activities | ❌ Non-qualifying activities |

|---|---|

| • Comparing several ML models for recall and prediction accuracy • Testing several material types for a new drone frame • Refining an automated claims management process with poor outcomes | • Fixing bugs in a recently installed business analytics tool • Customizing an off-the-shelf CRM app • Replacing the current material with a well-known alternative |

💡 Tips for passing this stage:

- Document your problems, challenges, and unknowns encountered in the process

- Give evidence of trying different methods to solve the research problem

- Keep internal research notebooks, memos, and testing reports

4. Process of Experimentation

Your research must be systematic, meaning it should follow a logical process of testing different approaches and refining solutions through modeling, simulation, prototyping, or other iterative methods.

| ✅ Qualifying activities | ❌ Non-qualifying activities |

|---|---|

| • Benchmarking performance of two predictive analytics model versions • Split testing app loading speeds with two different tech stacks • Doing finite element analysis to compare structural stress tolerance | • Updating a software component without interactive testing • Using a reference architecture to implement cloud storage • Going with the first proposed app design |

💡 Tips for passing this stage:

- Show that compared multiple alternatives before finding the right option

- Keep records of early prototypes, model versions, and simulation results

- Document all failed attempts and explain why others worked

If you pass the four-part test, you’ll be able to claim back an income tax credit for qualified research expenses (QREs) like employee wages, supplies, contract research, and hardware costs.

Why R&D tax reporting is so difficult

The IRS can legally ask for the above proofs for five years after the year of your R&D and claim submission. During this time, you may be randomly selected (i.e., audited for no particular reason) or scrutinized for making large or frequent claims. Beware: Any discrepancies in the stated expenses versus supporting documentation will require you to dig deep and make extra justifications.

This makes R&D tax compliance rather taxing (pun intended), even with a CPA on call. Because it’s the business’s responsibility to keep meticulous records, track all time and spending on qualifying activities, and present these as easy-to-follow reports to the Feds.

🗂️ Administrative burden

A business must prove it’s spent money or other resources on R&D projects (not just regular operational activities) to qualify for R&D tax credits.

This adds a lot to people’s workload. Department managers and HR must explain what records employees need to keep and in which format. You may need to invest in specialized software (e.g., an MLOps platform to track model development experiments) or extra secure cloud storage.

R&D teams need to improve their documentation, while a compliance team (if you have one) must ensure records meet changing regulations and fix errors. This leads to endless ping-pong between departments as people scramble to find missing documents or finalize reports before the tax deadline.

Hair-raising fact: The previous (shorter) version of Form 6765 added 285,281 hours of compliance burden for US businesses. The new (longer) form will multiply these numbers.

⏱️ No way to accurately (or easily) track R&D time

No company spends 100% of its time on qualified R&D. Even prolific “research” people like engineers or data scientists will switch between regular ops, admin, and innovative tracks.

Besides logging hours (or estimates,) you’ll need to assign them to different projects, tasks, and activities and keep some records (e.g., a timesheet) as proof for authorities.

Building an employee time-tracking habit can be hard with manual timers and spreadsheets. Your team will be frustrated, skip obligations, or log guesstimations. In the “best” case… you’ll leave R&D money on the table. In the worst…you risk painful regulatory investigations.

Companies leave 10-30% of their R&D tax credit unclaimed due to the expense and difficulty of effectively documenting it.

📑 Poor documentation

The IRS wants R&D “receipts” — and patchy records mean smaller rebates, increased audit risks, or outright claims denials.

In June 2024, the IRS published a revised draft of Form 6765, an update to its “preview” of changes to Form 6765, released in September 2023. The new version outlines qualitative and quantitative information requirements many companies must provide for the 2025 tax return (due in 2026).

For now, the following information in Section G remains optional:

| Section G Qualitative information | Section G Quantitative information |

|---|---|

| • Name or identifier of the business component (e.g., Project Alpha #1) • Business component type (e.g., product, process, software, formula, etc.) • Component designation (e.g., a predictive pricing model) • Information sought to be discovered (e.g., main research hypothesis) | • Employee wage expenses allocated between direct research, supervision, and support by the business component • Costs of supplies, equipment rental or lease, and subcontractor expenses for each component |

In other words — the IRS calls for more detailed documentation during tax reporting. Implementing these changes will be time-consuming without extra support tools.

How to maximize R&D tax credits with automated time tracking

R&D tax reporting is about demonstrating clear-cut evidence you’re claiming money for qualified activities. Not a cent more.

Spreadsheets have typically been a go-to solution for collecting and storing this evidence, especially for smaller companies. But most teams quickly realize spreadsheets are too tedious and time-consuming to maintain, especially as businesses grow. At the other end of the spectrum, many people management and payroll apps are often too expensive and complicated for average users.

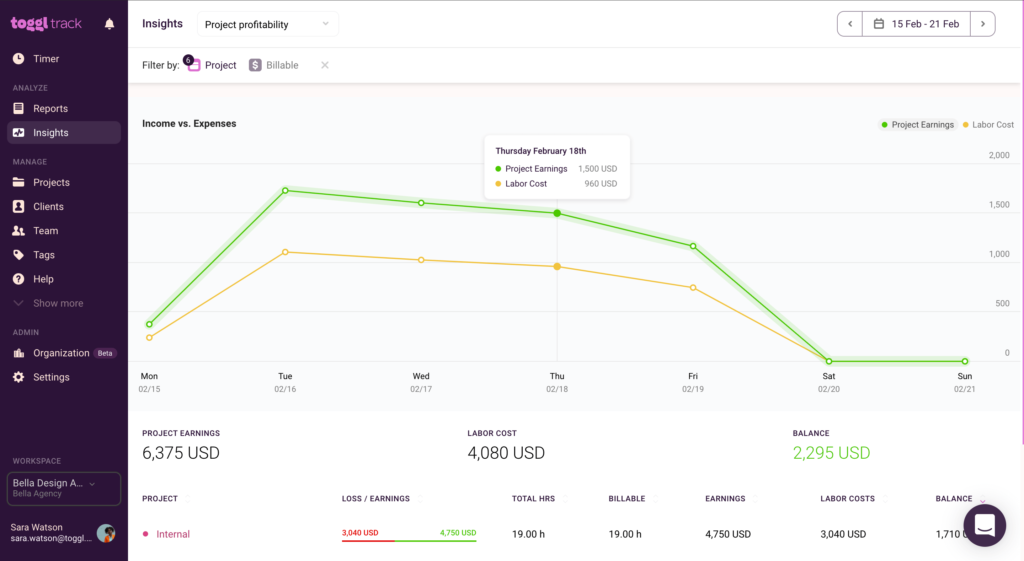

Toggl Track is the perfect Goldilocks solution for small to mid-sized businesses — it’s ‘just right’ for teams looking for sleek, scalable, and secure automated time tracking of QRAs and QREs. It’s more efficient than spreadsheets and has less distracting functionality than more complicated platforms.

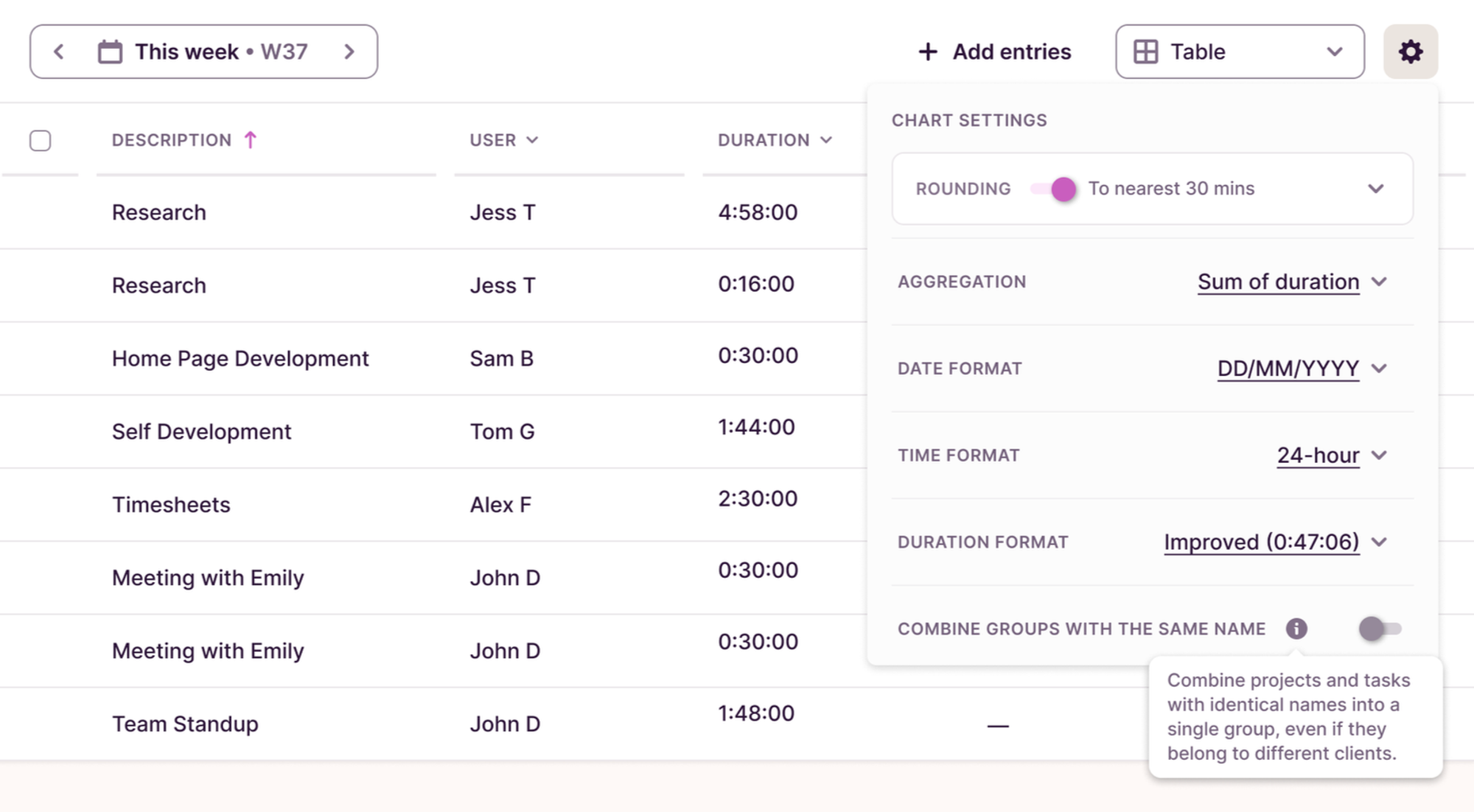

With a fast, one-time setup, Toggl Track allows you to automatically log all relevant tasks, projects, and expenses for teams of any size. After powering it up automatically on desktop devices and activating it in one click on mobile, Toggl Track seamlessly captures all work activities, allowing users to easily share their QRAs with admins.

Managers can easily account for related expenses using different billing rates (and easily track budgets, too!).

Toggl Track also includes audit and lock time entries to avoid errors and prove data integrity in case of an IRS audit. You can also share comprehensive reports with your accountants that break down time and expenses spent on various projects and activities — all of which must be disclosed in Section G.

Toggl Track: Your key to tracking qualified research activities accurately

We’ve built a time tracking experience that practically runs itself across desktop, web, and mobile and in 100+ popular business products (with a simple integration). This means your team will no longer need to:

❌ Keep messy research activity logs in a notebook

❌ Guess-timate hours for different tasks and projects

❌ Complain about hours wasted on “pointless” data entry

At the same time, you’ll get audit-ready reports for R&D tax credit claims and end-of-year reporting:

✅ Know exactly how much time goes into R&D projects with reports to track progress, set pace, and prepare reports.

✅ Capture qualified research expenses like employee wage and subcontractor expenses and get predictive budgeting insights.

✅ Streamline compliance with exportable expense reports and time logs without paying a ton for more complex software.

✅ Benefit from baked-in data security and integrity — private data hosting, locked time entries, SSO, and not a hint of employee surveillance.

…And if you run a bigger team, our Enterprise plan also includes a sweet volume discount and an even sweeter Customer Success Manager to help you set up R&D tracking dashboards and onboard new users. 😉

Get a done-for-you setup experience — full Toggl Track integration into your workflows, user configurations, and custom dashboard views — without a premium price tag.

Tips for 100% team adoption

Because Toggl Track is simple and non-intrusive, it’s an easy “sell” for the teams.

Netconomy achieved 100% adoption

“There is hardly any other solution that could handle such a large amount of data while providing a smooth UX experience for the team of 500.”

Engineers, software developers, data scientists, and C-suite members across industries love using Toggl Track. To join them, here’s how to ensure a smooth and streamlined adoption experience:

- Host a user training session (together with our Customer Success team on Enterprise plans), explaining the why and how of using time-tracking for R&D activities.

- Set up a Slack channel to answer any follow-up questions, share more features, and troubleshoot issues.

- Document all new requirements in a shared document in a company wiki for quick reference.

- Send an update on when time-tracking goes into effect. Give people about a week to play with our tool and have their A-ha moment.

- Configure automatic reminders to ensure everyone logs their activity on time and in line with compliance requirements.

- Add time-tracking training to your onboarding program for new hires to quickly build their habit.

Learn how to increase your R&D tax credit with time tracking during a free, personalized demo

R&D tax reporting doesn’t have to suck the life out of your brightest people or leave you with a ton of gray hair due to compliance fears.

With Toggl Track, you can effortlessly meet all the reporting obligations on Form 6765 and confidently claim the maximum applicable credit percentage.

Should anyone ask questions, you’ll use Toggl Track’s reporting capabilities to whip up irrefutable proof of your innovative R&D work.

Get the full experience of seamless R&D tax reporting with a walk-through from our team, showing all product features and data dashboard. Book your free demo here.

Elena is a senior content strategist and writer specializing in technology, finance, and people management. With over a decade of experience, she has helped shape the narratives of industry leaders like Xendit, UXCam, and Intellias. Her bylines appear in Tech.Co, The Next Web, and The Huffington Post, while her ghostwritten thought leadership pieces have been featured in Forbes, Smashing Magazine, and VentureBeat. As the lead writer behind HLB Global’s Annual Business Leader Survey, she translates complex data and economic trends into actionable insights for executives in 150+ countries. Armed with a Master’s in Political Science, Elena blends analytical depth with sharp storytelling to create content that matters.