More than 14,000 businesses in the US claim the federal Research and Development (R&D) tax credit in a year. If you rely on this funding, be aware that the claiming process has recently changed.

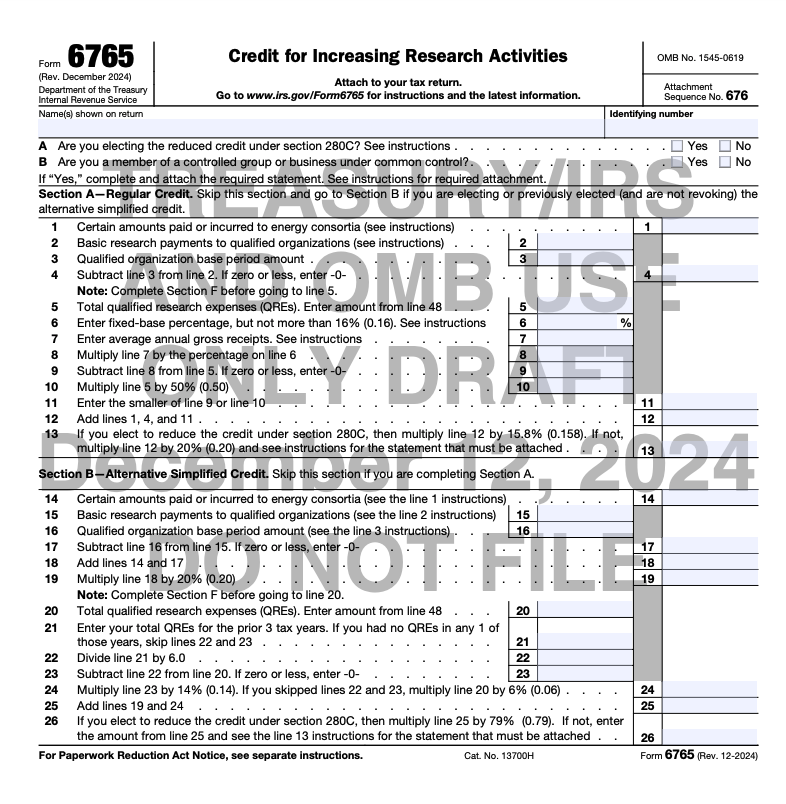

The Internal Revenue Service (IRS) has announced an update to Form 6765 — the Credit for Increasing Research Activities form — which gives businesses access to these tax credits. By filling out Form 6765 with the new requirements, businesses can calculate the amount of tax credit they’re eligible to claim — either by Regular Credit or Alternative Simplified Credit (ASC).

This guide breaks down the latest changes CPAs and other tax professionals need to know to stay compliant in 2025.

TL;DR — Key Takeaways

- Important changes are coming to Form 6765 that impact how businesses track their activities, time, and spending.

- Filing Form 6765 correctly allows R&D-heavy businesses to claim tax credits for the current year and is essential to remaining compliant with the IRS.

- There are three new sections and a few exemptions for filers to be aware of going into 2025.

- Implementing an automated time-tracking solution like Toggl Track will save you time and money, ensuring you file Form 6765 accurately and compliantly with zero stress.

Looking for more information on the R&D tax credit?

Our comprehensive guide answers all questions about the federal R&D tax credit, from eligibility and qualification to accurate reporting, in accordance with the latest rules and automated data collection tools.

Key changes to IRS Form 6765 in 2025

Historically, companies have used Form 6765 to report numerical, quantitative data. Qualitative documentation was sent to the archives in the event of an IRS audit.

But now? The revised Form 6765 requires businesses to include much more qualitative data directly with the tax return to explain what the claim is for.

Taxpayers must report the components that make up 80% of their total Qualified Research Expenses (QRE), with the number of business components capped at 50.

Despite being pruned back compared to earlier proposed changes to the form, this process still requires a significant reporting effort from the taxpayers to receive their incentive.

The IRS has invited taxpayers and clients to provide feedback on the following items through June 30, 2025:

- Section G Business Component information reporting for controlled groups (optional for the 2024 tax year but mandatory from 2025)

- Accounting Standards Codification (ASC) 730 Research & Development (R&D) Directive

- Section G Business Component detail

- Statistical sampling

What’s most important to know is that these changes in documentation and filing directly affect how businesses track their time since they must now implement detailed, project-specific time tracking to ensure compliance and maximize their R&D tax credit.

Section E: Other Information

The new draft form 6765 asks for additional information in Section E:

- Number of business components worked on during the current tax year

- Total officer wages

- Acquisitions and dispositions

- Whether any QREs were determined under the Accounting Standards Codification (ASC) 730 directive

Section F: Qualified Research Expenses Summary

A new section requiring an expense breakdown of:

- Total pay

- Supplies

- Rental or lease cost of computers

- Contract research expenses

These line items were previously in Sections A and B in older versions of the form.

Section G: Business Component Information

Another new addition to form 6765, here you’ll input:

- Details on controlled group members and activity codes

- Names and types of business components

- Software classifications

- Objectives of the research

- Breakdown of wage expenditures for direct research, supervision, and support by business component

- Costs for supplies, computer rentals or leases, and contract research by business component

This section must contain the required information from the 2025 tax year.

Exemptions from new reporting requirements

The new form is designed to make compliant reporting easier and faster for smaller businesses. If your business meets the following criteria, you may be exempt from some of the new reporting requirements:

- Section G is optional for Qualified Small Business (QSB) taxpayers, as defined under Internal Revenue Code Section 41(h)(1) and (2), who elect to claim a reduced payroll tax credit.

- Companies with total QREs of $1.5 million or less and gross receipts of $50 million or less, as determined under Section 448(c)(3), when claiming a research credit on an originally filed return, will also not be required to complete Section G.

Steps to submit Form 6765

You must document your qualified R&D expenses by completing the four basic sections of Form 6765:

- Section A is for claiming the regular credit and requires information on eight specific lines (1, 2, 3, 7, 8, 10, 11, and 17).

- Section B is for the alternative simplified credit (ASC).

- Section C lists additional forms and schedules that must be reported based on the business structure.

- Section D is only needed for qualified small businesses (QSBs) opting for a payroll tax election.

The IRS advises businesses to calculate their credit using the regular and simplified credit methods and then complete the section (A or B) that provides the highest tax benefit.

How does the US R&D tax credit work?

Normally, companies can use 6-10% of their qualifying research and development (R&D) expenses as a tax credit to directly reduce the amount of federal income tax they owe.

Example: If your company has $1 million in qualifying R&D expenses, you might be able to claim an R&D tax credit of $60,000-$100,000, which would directly lower your tax bill by that amount.

A tax deduction is not the same thing as this type of tax credit. The difference? A tax deduction lowers your taxable income, whereas a tax credit directly offsets the taxes owed.

So, what counts as a qualifying R&D expense? We go over that more in-depth in our full guide to maximizing the US R&D tax credit, but here’s a TLDR:

- Creating intellectual property such as processes, patents, formulas, techniques, prototypes, or software

- Dedicating time and resources to new product development

- Iterating, improving, or redesigning existing products

- Hiring the necessary staff to engage in qualified activities

- Expenses to run the R&D, such as salaries, supplies, and tools

If you’re unsure, the IRS outlines four tests that count as qualifying R&D expenses:

1. Section 174 Test: Making something new

Example: A car company spends money to design a new electric battery that lasts longer. The money spent on testing, designing, and improving the battery qualifies as R&D expenses.

2. Discovering Technological Information Test: Using science or technology

Example: A software company creates a new AI program to detect fraud in bank transactions. The program involves computer science and algorithms, qualifying it for R&D tax credits.

3. Business Component Test: Make a product, process, material, or software that helps the business

Example: A toy company develops a new type of plastic that makes toys safer and more durable. Since the new material improves their product, it qualifies.

4. Experimentation Test: Testing different ideas to improve over time

Example: A sneaker company tries different materials to make waterproof shoes that are still breathable. They test different combinations until they find one that works. The costs qualify for tax credits since they conducted an iterative testing process.

How to accurately document R&D activities

Keeping meticulous records ensures compliance with IRS requirements while maximizing your potential tax savings. Here are some best practices for tracking R&D expenses and activities:

- ⏱️ Maintain detailed time logs: Keep precise records of time spent on R&D activities, including employee hours for research, supervision, and support. Break down the work by business component (e.g., product, process, software).

- 💻 Use digital tools: Leverage time-tracking software and project management tools to track work on specific R&D projects efficiently. These tools automate reporting, making it easier to allocate expenses correctly.

- 💰 Document all expenses: Record every cost associated with R&D, including wages, supplies, contract research, and equipment. Make sure you categorize your expenses correctly to reflect the qualifying activities.

- ⚡ Review regularly: Audit your records regularly to keep everything up-to-date and avoid overlooking eligible expenses. This is a simple way to prevent costly errors during the credit calculation.

Accurate documentation ensures your tax credit claims are well-supported and reduces the risk of IRS scrutiny or audits. The more detailed and organized your records, the smoother the process will be when claiming the R&D tax credit.

Automated time tracking for accurate Form 6765 reporting

As we’ve seen, precision time-tracking is a key component to accurately and compliantly filing Form 6765. By automating your time-tracking, you’ll unlock tax credits (almost) on autopilot.

Small to mid-sized businesses don’t need the complexity of expensive compliance and payroll management systems but do need something more intuitive and functional than a basic spreadsheet.

Enter Toggl Track — the “Goldilocks” solution. Its simplicity and automation make it ideal for teams needing detailed, audit-ready time tracking to qualify for tax credits without overwhelming costs or complexity.

| ❌ Spreadsheets: Too basic | ✅ Toggl Track: Just right | ❌ Gusto: Too Complex |

|---|---|---|

| • Requires manual effort; super time-consuming to maintain, especially for larger teams | • Spotlight on R&D: See qualifying research, and activities, allocate wages accurately, and easily ensure compliance | • Overkill for smaller teams; complexity and feature set may exceed the needs of smaller companies |

| • Not scalable and lacks automation, notifications, and integrations for advanced workflows | • Minimal learning curve and full adoption, from engineers to finance leaders | • Longer onboarding; takes time for team to adapt |

| • High risk of human error, such as forgetting entries, which can jeopardize IRS audits | • Automation: Time tracking so easy, it practically runs itself; one click, or no clicks at all | • Costly; more expensive than tools like Toggl Track for what are often unnecessary features |

| • Know where time goes, down to the task and project | ||

| • Security and integrity: Audit logs, data integrity features, required field, reminders, SSO, locked time entries | ||

| • Integrates with your tools: Asana, Jira, Salesforce, Quickbooks and 100 others | ||

| • Pinpoint qualified research activities and separate them from all the others | ||

| • Multi-platform: Intuitive apps that work anywhere — lab, remote, or on the go | ||

| • See who’s working on R&D projects, what’s getting done, and how long it all takes — in one place |

Use Toggl Track for R&D compliance

R&D tax credits will be denied if you submit your form with only minimal information about expenses and activity hours.

Luckily, that’s exactly where Toggl Track excels. Our platform easily tracks every hour your team spends on eligible R&D tax credit activities so you can streamline your documentation and make confident claims.

But don’t take our word for it. Here’s what users have to say:

🌟 “The acceptance from all users is very high. I have seen a 40+ year employee move from their Excel-based tracking they have used forever, to this tool without any issue.” —5/5 stars review on G2.com

🌟 “Toggl Track helps me keep my reports in a way that’s easy for me to compile and easy for our accountant to read. It also lets me run reports with a wide range of customized date ranges (monthly, quarterly, weekly, daily, etc).” —5/5 stars review on G2.com

Ready to give it a try? Book a free demo to learn more.

Julia Masselos is a remote work expert and digital nomad with 5 years experience as a B2B SaaS writer. She holds two science degrees Edinburgh and Newcastle universities, and loves writing about STEM, productivity, and the future of work. When she's not working, you'll find her out with friends, solo in nature, or hanging out in a coffee shop.