With Hindsight: Toggl Plan’s Quarter 3, 2023

4 min read

Streamline project planning with Toggl Plan. Discover tips and strategies for effective scheduling, team collaboration, and achieving project success.

Here are our top articles starting from the basics.

Import your team's Google Calendar meetings and other events...

As an agency, you constantly juggle projects and deadlines....

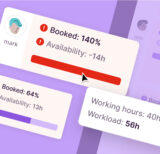

We’ve added new features that help you plan and...

Client project timelines, flexible recurring tasks, running timers, and...