Wouldn’t it be great if we could charge clients for every hour we work? Sure, but that’s not the reality.

Only some of our work hours are directly billable, and the rest of the time, we’re knuckling down to crucial non-billable work. That’s the stuff that keeps the business running but isn’t easy to assign to a particular client or project.

But trying to distinguish between billable vs. non-billable hours isn’t always easy. This guide will set the record straight and provide actionable insights for better work time tracking and management.

What is the difference between billable and non-billable hours?

Billable hours are the time you spend working on a client’s project. Non-billable hours refer to any extra time spent on administrative tasks, such as training or overhead projects, that you can’t link to a specific client.

As lead consultant Cory White puts it, “One thing you realize very quickly as a consultant versus an employee of a company is that you do not get paid for every hour you work.”

Here’s a quick overview of the main differences between billable and non-billable hours, with a focus on billing rate, business impact, and priority.

| Billable hours | Non-billable hours | |

|---|---|---|

| Description | Total hours worked directly on client tasks and projects. | Total hours worked on non-project tasks. |

| Purpose | Complete client projects and generate income | Support business operations |

| Billing rate | Invoiced directly to the customer. Usually based on an hourly rate or fixed fee. | Not billed directly to customers. Typically absorbed by the company. |

| Business impact | Directly contributes to revenue and profit | Supports smooth business operations and improves an agency’s capability to deliver projects |

| Priority | Often top priority as they directly affect the bottom line and are time-sensitive. | Secondary to billable hours but still necessary for long-term success. |

Billable hours

Billable hours are the hours your team spends delivering client-specific project tasks. The most basic reason to track them is to bill clients and get paid. But there’s a little more to it than that.

When you track billable hours in detail, clients can see exactly how you’re spending their money, and you’ll also learn whether you’re charging them enough for the size and scope of their projects.

Examples of billable hours

Here are some examples of billable tasks:

- Project planning, management, and other related tasks

- Actual client work involved in creating the project deliverables — for example, research, designing, writing, coding, editing, etc.

- Creating spreadsheets or other project-related documents

- Client meetings, consultations, phone calls, and other communications

- Project deployment, client-related training, etc.

Non-billable hours

Non-billable hours are hours spent on administrative tasks that keep the mechanics of your business ticking over. They’re not directly chargeable to any specific client, but they’re nonetheless essential to your internal operations.

Examples of non-billable tasks

Here are some examples of non-billable tasks:

- Internal team meetings and training sessions

- General administrative tasks include bookkeeping, filling out timesheets, and email communication

- Business and employee development.

- Sales pitches or marketing activities not tied to any specific client

- Any employee time spent on bids or proposals that weren’t accepted

Challenges in tracking billable and non-billable hours

Try to remember what you did at work last Thursday. When did you start? When did you call it a day? How many breaks did you take? How many minutes did you spend answering client emails, working on a new project, or chatting with a colleague about their new puppy?

Unless you’re keeping track of your billable and non-billable hours properly, you won’t have a cat in hell’s chance of accurately remembering what went down. So, that’s why you need a clear plan, with solutions to the following problems baked in.

1. Lack of organizational standardization

Different employees or departments may interpret billable vs. non-billable hours differently, leading to inconsistencies in your invoicing.

💡 Solution: Set up comprehensive documented guidelines related to timekeeping, including:

- Clear and concise definitions of billable and non-billable hours, with typical examples

- Instructions on how team members should classify each type of activity, with guidelines on how to account for specific hours

- Contract or client specifics, such as whether project status updates are a billable or non-billable action

2. Resistance to change

Not everyone embraces new time-tracking tools and strategies. This reluctance is often visible in long-time employees who’ve gotten used to creating manual timesheets and may not want to invest in learning a new method.

💡 Solution: Strong communication is your friend here:

- Talk to your people about the benefits of time tracking, both on a personal level and for the company’s profit margins

- Promote a work environment where employees feel encouraged to report their hours honestly

- Lead by example to persuade your team to follow suit

3. Complexity of time tracking systems

With an intuitive time-tracking system, tracking billable and non-billable hours can be a breeze. Or it can be a total headache if you’re using something more cumbersome. No one wants errors, delays, or frustration creeping into their workflow.

💡 Solution: Opt for a streamlined and automated system like Toggl Track that prioritizes convenience with straightforward navigation. Basically, it’s a cinch for users to log in their hours and activities quickly. Additionally:

- Automated reminders ensure timely entries

- Customizable project and task categorization enhance accuracy

- Visual dashboards and real-time reporting provide quick insights

- Integration with project management tools minimizes manual data entries

A quality platform like Toggl Track should also include robust training resources to minimize the learning curve for all users.

4. Data security concerns

When working with client data, you’ll need watertight processes to track the time you spend on their confidential work.

💡 Solution: Use a secure time tracker like Toggl Track, which:

- Creates full data backups every 24 hours

- Stores data in separate physical locations

- Hosts sensitive data on the Google Cloud Platform (GCP), which adheres to Cloud Security, Cloud Privacy, and Payment Card Industry (PCI) Security Standards, among other things

Thousands of businesses trust Toggl Track with their sensitive information, ranging from start-ups to Fortune 500 companies. Read through customer stories here.

5. Concerns about cost

Small companies and start-ups, in particular, must keep a close eye on their bottom lines, so the time tracking system you use should help you save money rather than add unwanted costs to your business.

💡 Solution: Toggl Track has a free plan just for this situation, which:

- Includes basic time-tracking features and allows up to five users to track their billable and non-billable hours.

- Suits start-ups with small teams, freelancers, or solo users

- Enables you to upgrade to a paid subscription at any time to unlock more powerful features and add more users (our premium plans are great at spotting inefficiencies in your work, which will save you money in the long run)

6. Client disputes

Client disputes can become a severe problem if things are not clear from the start. A lack of transparency or proof supporting billed hours can result in time-consuming client disputes and reputational damage. No one wants to go viral on LinkedIn over dodgy invoicing, do they?

💡 Solution: Avoid losing a client (and any future projects) by:

- Setting clear expectations with new clients before starting any project

- Telling them about your billing rates and how you track billable hours

- Being as transparent as possible about what tasks are billable and what aren’t

7. Client communication problems

Communication and transparency are critical to a healthy business relationship. Clients want to understand the details of the total billable hours you’re charging them for.

💡 Solution: Use time-tracking software like Toggl Track to generate summarized or detailed time reports you can share with your clients. Both types of reports are great for keeping clients in the loop. They let them know exactly what they’re paying you for and in what amounts.

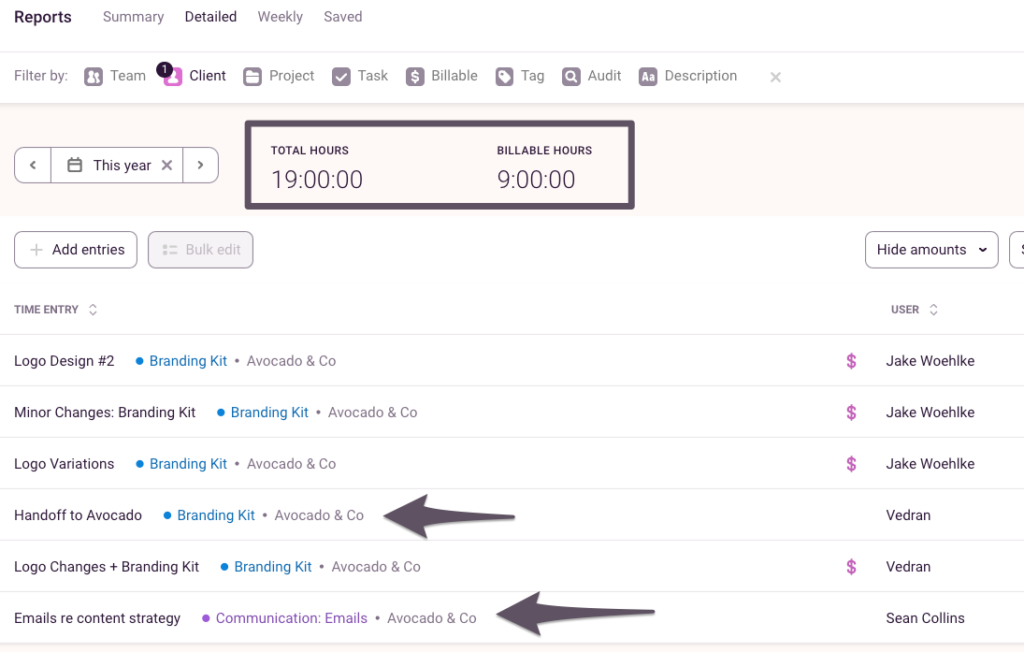

The Detailed time report goes deeper into the data and shows each data entry. You can filter the Detailed report by User/Team, Client, Project, Task, Tag, Billable flag, or Description.

Both types of reports are great for keeping your client in the loop. They let them know exactly what they’re paying you for and in what amounts.

Why is it important to track both billable and non-billable hours?

It doesn’t take much to convince most people to track their billable hours — clients are unlikely to pay them if they don’t keep an accurate account of their work. But more people are on the fence about logging their non-billable activities.

Here’s why we believe both are critical.

1. Improving financial and resource management

Accurately distinguishing between billable and non-billable hours allows businesses to benefit from efficiencies across the entire company beyond any employee’s input into client work. Instead of viewing non-billable hours as lost productivity, firms should see them as an opportunity for growth.

Fraser Moore, managing partner of Quadrivium, explains: “There’s so much value that your consulting team can contribute to the development and growth of your own business if their non-billable time is planned and managed effectively.

Being smart about how you leverage non-billable time helps deepen the relationship between employee and employer by allowing them to play a crucial and meaningful role in developing the essence of the firm.”

2. Enhancing career development

Tracking non-billable hours can also impact individual career progression. Many professional services workers focus intensely on billable work but overlook the important non-billable contributions they make to their organizations. By tracking everything they do, professionals can showcase the breadth of their contributions, making a stronger case for promotions and leadership roles.

David Ernst, a succession planning professional for lawyers and law firms, shares his experience:

“When I was an associate, I was way too focused on billable hours and sloppy about recording non-billable time. As a result, when I came up for partner and was asked about what I was doing to advance my career besides billing time, I had lousy data and a less-than-inspiring answer. Even if the culture of your firm is to not track or look much at non-billable time, I strongly recommend that you record your time in this area.”

3. Ensuring greater profitability

It’s all about the money, honey. And the balance between billable and non-billable hours is crucial for any service-based business. Whether you’re in consulting, marketing, IT services, law, or accounting, profitability depends on effectively tracking and managing your time.

Without visibility into their hours, firms risk underestimating their operational costs: If too much time is spent on non-billable activities and they don’t quote enough for client projects, profit margins shrink.

But striking the right balance between billable and non-billable isn’t easy, as Wendy Merrill, CEO of Strategy Horse, explains: “The billable vs. non-billable tug of war is a permanent fixture in the life of a private practice lawyer. Achieving the right balance is the key to law firm profitability.”

This struggle applies to any organization where revenue is directly tied to time worked. Tracking employee hours allows companies to differentiate essential non-billable work (like professional development or firm-building initiatives) from time-wasting activities.

Common mistakes when tracking billable and non-billable hours

Mistakes are the enemy of billable hours. But unfortunately, it’s all too common for errors to slip in when businesses track their work time. We’ve listed them here so you don’t trip up!

1. Tracking time manually

Doing anything manually is a bad idea because humans are flawed creatures, and we make mistakes. Lots of them, in fact. Team members might round up or down, and some will forget to log their billable hours at all.

💡 Solution: Use a time-tracking tool to track your team’s billable and non-billable hours accurately.

Toggl Track has features like:

- One-click timers to get your people tracking time immediately — no onboarding required

- Automated time tracking for more accurate time entries

- Summary and Detailed reports to view, filter, and sort your data. You can also create dynamic reports so clients can track your work in real-time

- Assign billable rates by employee, team, or project and see what’s generating revenue

- Project estimates to determine how your actual work compares to your assessments.

- Access to historical billable rates for better forecasting.

In real life, the reporting dashboard below quickly highlights each project or client’s total billable and non-billable hours.

In the example, nine out of the total nineteen hours are billable. Only two tasks are non-billable: a handoff and some emails regarding content strategy. It’s all there in black and white (and some purple and blue) so you don’t have to worry about inaccuracies.

2. Forgetting to track in real-time

Waiting until the end of the workday or week to log hours is a surefire way to end up with serious inaccuracies. Real-time tracking is the way to go if you want to keep an accurate record of all activities as they happen.

💡 Solution: Use a time tracker that lets you track time anytime and anywhere.

Toggl Track, for example, enables your team to track their time from the web app. You can also track your work while browsing (the browser extension is shown below), using the desktop and mobile apps, or through third-party integrations.

Toggl Track also lets you track time even when you’re offline, which is great if you need to track work during a power outage.

Toggl Track integrates with over 100 popular tools like Asana, GitHub, Slack, Google Docs, and Freshdesk. If you’re logged into any of these apps (and countless others), it’s easy to track time using any of these tools while working on your projects without having to flit between screens.

3. Overlooking short tasks

Two minutes here, five minutes there — they all add up over time. Yet many people make the mistake of overlooking short tasks and brushing them off.

💡 Solution: Use an accurate time tracker that accounts for every moment of your employee’s work time, so no second of your work day goes unexplained.

Remember: Your tasks may be small, but they’re also significant. Forget or neglect to track them, and you could be looking at substantial unbilled work hours that can majorly impact your bottom line.

4. Skipping manual activities

Not all of your good work happens at your desk. In fact, many crucial client activities happen face-to-face in meetings or on calls, both during and after working hours. But it’s still as vital to track this work as anything else if you want to bill correctly. (And we all want that!)

💡 Solution: Leverage a time-tracking system with mobile capabilities.

It lets you monitor your activities while on the go or offline. A flexible time tracker like Toggl Track also allows you to add manual time entries later. Whether you don’t have your time tracker or simply forgot, you can still add the work time into the system.

In addition, Toggl Track connects with popular calendar applications and shows meetings and other events on the Timeline view. This feature makes it easy to add time entries related to specific events.

5. Forgetting about your breaks

Depending on your client agreement, breaks are usually non-billable. So, you’ll need a tracker that knows when to switch between lunch and work.

💡 Solution: Use a time tracker with built-in idle detection.

Say an employee takes a few breaks during a task but fails to pause the time tracker. With Toggl Track MacOS and Windows apps, team members receive a notification for any time they’ve been inactive or away for a predetermined number of minutes.

When it appears, team members have four options to choose from:

- Discard idle time: You stop the running timer and discard the idle time

- Discard idle and continue: You start a new time entry matching the previous one (it also ignores the idle time)

- Add idle time as a new time entry: You stop the running timer and add the idle time as a new entry

- Keep idle time: You ignore the idle time and add it to the current time entry

6. Neglecting staff training

Do your staff know how to track their work time? Do they really, and are they all doing it in the same way? Whatever your strategy, tool, or preferred workflow, it’s important that everyone’s on the same page.

After all, if team members don’t know the importance of time management or how to track their work time properly, they can experience consistent errors.

💡 Solution: Conduct regular training sessions on efficient time management and using time trackers effectively. Make sure that both your employees and managers attend these training sessions.

Strategies to optimize non-billable utilization

There are six tried and tested strategies to strike the right balance between billable and non-billable hours.

1. Setting non-billable hour limits

Non-billable work is important, yes. But you’ll probably want to set a maximum limit on your non-billable hours. That way, you’re granting employees “permission” to invest in admin work but still maintaining a focus on bringing in the cash. A limit keeps everyone conscious of how they’re spending their time.

Say, for instance, a software-developing company decides to set limits on non-billable hours. They review their essential non-billable hours and determine a reasonable limit like:

- Daily: 1 hour

- Weekly: 5 hours

- Monthly: 20 hours

The software developer determines these limits based on the type of work and the total number of billable hours they’re expected to do every day. The company then communicates these limits to all relevant stakeholders.

It also explains the reason for these limits and how team members should track their non-billable hours. With a time tracking system, staff members can easily classify their work time as billable or non-billable.

At the end of each month, the company analyzes the data and identifies those who exceed those limits. They might meet to determine what happened and devise ways to reduce that non-billable time.

2. Batching non-billable tasks

A second strategy is to group similar non-billable tasks so you can whizz through them in one hit.

For example, a marketing design agency has a list of essential non-billable activities it needs to complete each week. These activities include employee training, internal meetings, and other administrative work.

Here’s an example of how the agency clumps these jobs together:

- Monday: All administrative tasks like emails, responding to clients, updating projects, etc.

- Tuesday: All internal and external meetings with team members, clients, vendors, partners, etc.

- Wednesday: All training activities like webinars, compliance training, time management training, etc.

By batching similar tasks, your team doesn’t have to switch context often. This is a great productivity hack that keeps everyone focused on similar tasks so they can finish more quickly.

3. Adjusting your pricing

Baking non-billable time into your billable hours is another savvy move. It might sound like cheating, but it’s not.

Example: A video production company has a project that needs to be completed in 200 hours, but they also know there are additional tasks like script revisions, internal meetings, and so on.

The company adds up these non-billable hours and adjusts their hourly rate accordingly. So, instead of charging $100 per hour for all 200 hours, the agency may charge $120 per hour for 180 billable hours.

This way, non-billable hours are no longer a financial burden since the price includes these hours as well.

4. Prioritizing essential non-billable activities

You should also identify and prioritize essential non-billable tasks, such as business development or internal process optimization.

If you’re a digital agency, optimize your non-billables by first identifying all non-billable activities your agency completes (i.e. admin work, training, networking, business development, marketing, etc.). Evaluate each one and determine its impact on your business.

Consider these factors:

- Does it support the agency’s goals, mission, and vision?

- Is it essential for day-to-day operations?

- Does it maintain or build the agency’s reputation?

- Does it improve efficiency and profitability?

The more these boxes it checks, the more critical the non-billable activity is, so you should tackle these first. Keep in mind that the importance of non-billable activities can change with time. It’s worth regularly reviewing the list of activities and making the necessary changes.

5. Outsourcing as required

Another helpful strategy is to outsource non-billable activities, particularly low-priority administrative tasks. This frees up your employees to focus more on billable activities.

For example, a software development company might outsource administrative tasks like invoicing, bookkeeping, or payroll to an accounting firm.

6. Automating administrative tasks

Technology can streamline and automate many time-consuming tasks — the really boring stuff, like scheduling, invoicing, or data entry. Important? Definitely, but not the best use of your time.

To automate your daily non-billable time, work through the following steps:

- Start by identifying what non-billable tasks you can automate. Think emails, reports, data entry, appointment scheduling, reminders, notifications, etc.

- Find the right digital tools to match these activities.

- Evaluate different options and choose those that best suit your business needs. Consider factors like must-have and nice-to-have features, ease of use, customer service, scalability, and cost.

- Implement those solutions. Keep in mind that you may need to develop new workflows.

You may also have to integrate these new tools with your existing systems, and your employees may need some onboarding to use them effectively. - Monitor these newly automated tasks and make sure they’re working as expected. It’s unlikely you’ll find the best workflow on your first try. You also may need to make adjustments as your needs change over time.

Track time and improve profits with the right tool

Mastering the balance between billable and non-billable hours is about working smarter and ensuring every hour contributes to your company’s success.

The key takeaway? Time is your most valuable asset, but only if you know how to track and manage it correctly.

By implementing effective time-tracking strategies, setting clear standards, and using automation tools like Toggl Track, you can eliminate inefficiencies, make data-driven decisions, and improve overall profitability.

Sign up for a free Toggl Track account and learn how to automate your billable and non-billable time tracking to precision.

Rebecca has 10+ years' experience producing content for HR tech and work management companies. She has a talent for breaking down complex ideas into practical advice that helps businesses and professionals thrive in the modern workplace. Rebecca's content is featured in publications like Forbes, Business Insider, and Entrepreneur, and she also partners with companies like UKG, Deel, monday.com, and Nectar, covering all aspects of the employee lifecycle. As a member of the Josh Bersin Academy, she networks with people professionals and keeps her HR skills sharp with regular courses.