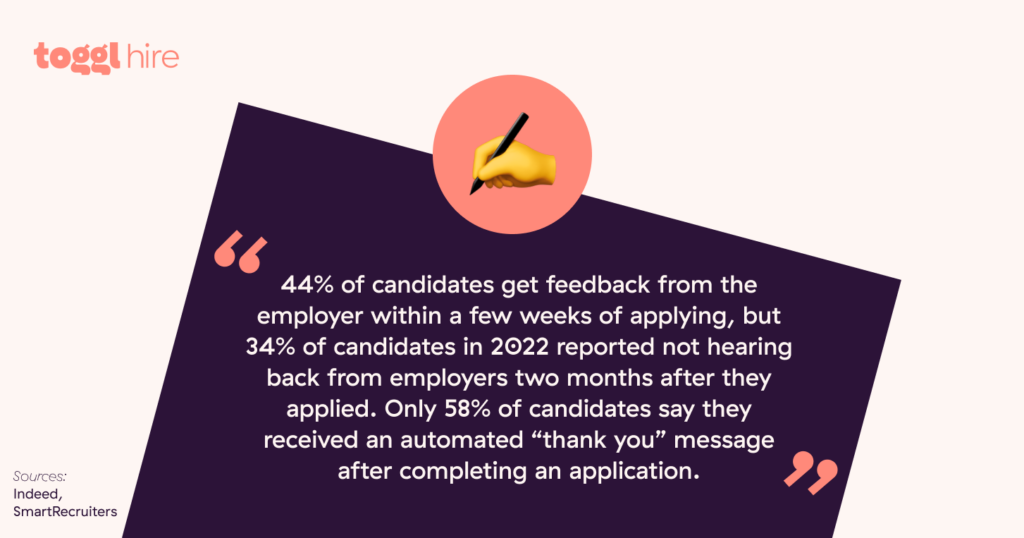

“The communication between recruiter and candidate is weak. Even after following up multiple times, they don’t respond. Feels like talking to a bot.” -Feedback from an actual job applicant

We hate to say it, but the average candidate experience today kind of stinks—so much so that it’s one of the top reasons candidates reject a job offer.

The good news is that there’s a way to find out what applicants think about you as an employer: by measuring your candidate Net Promoter Score.

Buckle up as we explain how to measure and nail this metric and why it’s crucial for improving the hiring process.

TL;DR — Key Takeaways

Candidate NPS or cNPS measures how satisfied candidates are with your hiring process and is a key indicator of how likely a candidate is to recommend you as an employer.

This score is important because it can help improve the candidate experience and employer branding and lend actionable insights on what to improve in your recruitment process.

To calculate the cNPS, tally up the results from candidate surveys to get the number of detractors, passives, and promoters. Then, subtract the detractors from the promoters.

To benefit from candidate NPS, make sure to ask the right (follow-up) questions in your surveys and experiment with using them at different stages of the hiring process.

Other best practices include tracking the cNPS for all candidates, both accepted and rejected, and benchmarking against industry standards.

What is candidate NPS?

A candidate NPS or candidate Net Promoter Score (cNPS) measures how satisfied candidates are with your hiring process. It’s adapted from the traditional NPS, which measures customer loyalty and satisfaction.

The principle is the same as in the standard NPS: candidates get a question on how likely they are to recommend your hiring process and you as an employer.

For example: “On a scale of 0-10, how likely are you to recommend our hiring process to others?” Based on their responses, they are placed into one of three groups: detractors, promoters, or passives.

NPS is a quick, easy, and quantitative way of collecting candidate feedback (but if you’re confused, sit tight, as we’ll explain how to use and measure NPS in more detail below).

Why is the candidate net promoter score important?

A candidate experience survey is a tangible, measurable way to assess and improve your candidate experience. In a time where 4 out of 5 candidates think that candidate experience is a sign of how companies value their people, it’s pretty important to keep tabs on this recruitment metric.

In general, feedback regarding the hiring experience these days isn’t great, with 60% of candidates reporting a poor experience. Given that 72% will share it with the world on platforms such as Glassdoor, it’s easy to see why it’s worth knowing your cNPS score.

Other reasons why your candidate NPS score matters include the following.

Improves candidate experience

The candidate NPS helps your team find gaps in your hiring processes. It highlights poor candidate experiences and tells you which candidates to contact for additional feedback.

Improved candidate experience can lead to higher satisfaction with the hiring team and build a better employer brand for your business. With strong candidate experience, there’s also a higher chance of positive word-of-mouth going around about you (and that never hurts).

Basically, since you can run cNPS surveys throughout the hiring funnel, you can get to the bottom of what your applicants really think.

Enhances employer branding

Candidates who score highly on candidate experience surveys are more likely to provide favorable feedback about employers online.

These candidates are more likely to praise you on LinkedIn, Glassdoor, and various other online communities. This boosts your employer brand and makes you more attractive to future job seekers.

Remember, this works both ways. A positive candidate experience can enhance your employer brand, but having an employer branding strategy can also boost your candidate experience! What a nice little loop.

Reduces drop-off rates

If candidates drop off mid-application, this usually means that something’s not right in the hiring process (even if it’s unintentional). With cNPS and the right candidate experience survey questions, you can discover why you’re losing candidates before they hit “submit.”

More importantly, by focusing on candidate satisfaction, you should be able to prevent losing the most qualified candidates because of something as trivial as an overly complex recruitment process.

Knowing why candidates drop off in the application process can be critical to boosting your candidate experience. Don’t miss out on a gem because of common mistakes like:

- A lengthy or overly complex application process

- Mandatory cover letter (these are outdated, anyway!)

- An application form that isn’t mobile-friendly

- Lack of feedback and communication

Provides actionable insights

A candidate’s Net Promoter Score is a tangible, measurable data point that you can use to benchmark your candidate’s experience. Based on this score, your hiring team can make more informed decisions about the recruitment process.

More importantly, once a benchmark is set, you can easily track progress over time and see how you compare against industry standards.

How do you calculate candidate NPS?

Calculating a candidate’s NPS is just as simple as calculating a regular NPS. Every NPS survey asks similar questions, with the answer ranging from 0 to 10. For example, “How likely are you to recommend our hiring process on a scale from 0 to 10?”

Based on the answers, survey participants are placed into one of three categories:

Promoters (scores 9-10): Candidates who are employer brand ambassadors and likely to recommend you to others

Passives (scores 7-8): Candidates who are satisfied but not very enthusiastic about promoting you as an employer

Detractors (scores 0-6): Unhappy candidates who can do damage to your employer brand by speaking out about their candidate experience

The NPS score is a number that you get by subtracting your detractors from your promoters. Or, to use a formula:

NPS = %Promoters − %Detractors

If you’re looking to work out your candidate NPS, the process is fairly simple. In fact, most survey software does it automatically once survey responses start coming in. But if you want to know the finer details behind measuring candidate NPS, this is how it works.

Step 1: Calculate detractors

Let’s say you had 100 job applicants for your latest job opening. You ran a survey to calculate the candidate Net Promoter Score, and the results came in like this:

60 applicants responded with a 9 or 10 (Promoters)

20 applicants responded with a 7 or 8 (Passives)

20 applicants responded with a 0 to 6 (Detractors)

In this simple breakdown, you have 20% detractors. These are applicants who, for whatever reason, weren’t satisfied with something. It could be the hiring manager, the interview questions, how they were kept informed throughout the hiring funnel, etc.

Got detractors? Don’t panic. There will always be at least a few. Whether or not someone likes the hiring and application process is, of course, subjective. However, your goal is to reduce this score as much as possible. How? More tips on that below!

Step 2: Calculate passives

Based on the example above, 20% of applicants are passives. This is arguably the most important group of applicants to target for recruitment marketing. These candidates perceive your recruitment process as satisfactory but not superb. As such, they’re unlikely to use word-of-mouth or other platforms to promote you as an employer.

Hiring managers, listen up! Uncovering that extra step that delights this pool of candidates is the low-hanging fruit you need to find to create a more positive candidate experience for future applicants.

Step 3: Calculate promoters

Based on our example, 60% of applicants are promoters, which means you’re on track for recruitment success. These candidates have high cNPS scores, and they’ll likely be very vocal about supporting you both online and offline.

Just because promoters are happy doesn’t mean that they should be left alone. Make sure to utilize these applicants as employer brand ambassadors by asking them to share their thoughts on your most important platforms.

Step 4: Subtract promoters from detractors

Now that you know how many applicants you have in each group, you can calculate the cNPS score, which is a single number.

In our case, we subtract detractors from the promoters or do the simple math of 60-20, which gives us a cNPS score of 40.

The cNPS score can range from -100 to +100. The higher the score, the better.

How to use candidate net promoter scores to build a better hiring process

Congratulations, you now have a number that you can tie to your candidate experience!

However, that number alone won’t do much for your overall hiring efforts if you don’t know how to use it properly. Pay attention to these best practices to make the most of your cNPS strategy:

#1 — Ask the right questions in the NPS survey

The typical NPS survey only has one standard question. However, that doesn’t mean you can’t create additional candidate experience survey questions.

Here are a couple of examples we’ve used in the past:

“On a scale from 1 to 10, how accurate was the job description compared to the duties described in the interview?”

“How would you rate our interview process on a scale from very satisfied to very dissatisfied?”

Aside from asking questions that require candidates to rate their experience on a scale, you can also ask open-ended questions to get more detailed feedback on your recruitment process, as well as additional follow-up questions based on the responses to your initial set of questions.

For example, if someone says they’re very dissatisfied with the interview process, you can ask them to elaborate on their thoughts with an open-ended question.

Beware of overloading the job applicants and causing survey fatigue with too many questions or questions that require detailed answers. For NPS surveys to be effective, they need to be clear and quick to complete!

#2 — Use candidate experience surveys at multiple stages of the recruiting process

cNPS surveys can be used throughout the candidate journey. For example, after the initial application, after the interview stage, after the test task, etc.—and can help identify which stages are working best for your applicants.

Decide which stage of the hiring process needs the most attention, place the survey at this point, and automate the survey email in your ATS or hiring tool of choice. For example, if interviews are your pain point, send out cNPS surveys to every applicant who goes through this stage, regardless of how they perform.

Regardless of when or how you send out your survey, having benchmarks for different stages of the hiring process helps you gain a holistic view of your hiring practices and how job seekers perceive you as an employer.

#3 — Track cNPS for rejected and hired candidates

Remember to track cNPS for the candidates who drop out of the hiring funnel, as there are more of them. However, make sure to include rejected and hired candidates to get a bird’s-eye view of your recruitment processes, as well as those who made it to some point in the funnel but did not get the job.

While feedback from rejected job seekers can be highly valuable, it also tends to be skewed. Since they’re upset that they did not get the job, their feedback tends to be negative. This is why it’s important to include every candidate—not just a select few.

#4 — Benchmark against industry standards

cNPS is easy to compare, and not just against your own benchmarks. For example, the average cNPS is anywhere from 37 to 69.

Candidates that have gone through more than one stage of the hiring process produce a cNPS of 28. Those who receive the job offer provide an average score of 62.

It’s hard to determine which cNPS you should aim for, but anything higher than +30 should be considered in the safe zone. Industry-level benchmarks can be hard to find, so it’s best if you focus on beating your own benchmarks for the beginning of your cNPS journey and work from there.

Automate candidate feedback and improve candidate experience with Toggl Hire

Candidate experience surveys like the cNPS are an easy, quantifiable way to measure the effectiveness of your hiring process and the candidate experience.

Given how easy they are to conduct and compare, any company that is serious about its candidate experience and employer branding should consider introducing cNPS into its hiring processes. Try Toggl Hire if you’re looking for an efficient way to automate collecting feedback from applicants as well as improve the overall candidate experience.

Toggl Hire helps you collect feedback from candidates automatically and gives you real-time analytics about your hiring processes. Streamline how you communicate with candidates and make your candidate feedback processes simpler—all while getting actionable insights on what to improve and how.

Sign up for your free Toggl Hire account and get started today!

Mile is a B2B content marketer specializing in HR, martech and data analytics. Ask him about thoughts on reducing hiring bias, the role of AI in modern recruitment, or how to immediately spot red flags in a job ad.