How many recruiting metrics are there, and which one should you track?

That’s similar to asking, “How long is a piece of string?” While a piece of string can be any length, great hiring managers and recruitment teams should aim to track as many recruiting metrics as they can.

The reason is twofold: By accurately measuring the impact of your hiring efforts, you can find out what you can improve across the recruitment funnel. Tracking metrics also makes your recruiting efforts more data-driven.

Now, which are the important recruiting KPIs your team should track? Keep scrolling to find out.

TL;DR – Key Takeaways

Recruiting KPIs are measurements that hiring professionals use to keep track of their hiring efforts

They are important because they let you keep your finger on the pulse and find out what you are doing right and what needs changing in your recruiting strategy

There is no such thing as the most important recruiting KPIs – they depend on your company, business, role, seniority and many other factors

There are five main groups of recruitment KPIs: sourcing metrics, speed and cost metrics, candidate experience metrics, hiring quality metrics, and employee metrics

What Are Recruiting Metrics?

Recruiting metrics are measurements that HR professionals use to track and optimize their hiring efforts throughout the recruiting process.

When done right, recruiting metrics can show you whether you’re hiring the right people, using the right channels for hiring, sourcing in the right way, and much, much more.

Why Are Recruiting Metrics Important?

There are many reasons why using metrics in your recruiting process is important. They:

Allow you to make data-driven decisions

Help determine whether you’re hiring the right people

Show you how much time and money it takes to hire someone on average

Show bottlenecks in your recruiting process

Let you compare your hiring metrics against overall company goals

For example, imagine you find yourself struggling to fill open roles in your business. Because you’re on top of your recruitment metrics, you figure out that you have a low application completion rate. Now you can redesign the application and unclog your funnel to get more top talent.

These key performance indicators (KPIs) give you an overview of your entire recruitment funnel and show you what works and what can be improved.

What Is the Most Important KPI in Recruitment?

There is no one answer that is correct here, as all businesses are different.

The most important KPI will depend on your overall hiring goals. For a company on a tight budget, the cost of hire might be the number one metric they track. On the other hand, a company struggling to fill positions quickly will be concerned with the time to fill the most.

Simply put — it depends.

SOURCING METRICS

1) Source of Hire

Definition: The percentage of hires that came from each channel. Examples include paid ads, job boards, referral hires, direct sourcing, and others.

Why you should track it: To find out which hiring channels work and produce the best candidates. If you find that posting on a niche job site works better than a major job board, for example, you’ll know where to focus your recruiting funnel efforts.

Industry benchmark: Varies depending on your industry, niche, type of role, seniority, and more.

Formula: # of hires / total number of candidates from a particular source

2) Sourcing Channel Cost and Efficiency

Definition: How effective a certain channel is in driving new job seekers to your openings.

Why you should track it: To find out which channels produce the best candidates at the lowest cost per hire.

Industry benchmark: Depends on the sourcing channel. For example, Monster.com starts at $249 per month for one role.

Formula: Recruitment costs from a platform / total number of qualified candidates from the platform

3) Percentage of Open Positions

Definition: The number of open positions in a department compared to the total number of open positions in the company.

Why you should track it: Having a high number of open positions in a department could mean that:

There is a high demand or low supply of labor in this area

Your business is under-performing, or you have low retention rates in a department

Your business is experiencing growth in a certain area

You can track this recruiting metric across time to identify seasonal patterns. Larger organizations can analyze it by department to better determine recruitment budgets.

Industry benchmark: Depends entirely on your organization’s goals.

Formula: Open positions (%) = (number of open positions / total number of positions) x 100

4) Number of Applicants

Definition: The total number of people who apply to your job postings.

Why you should track it: The number of applicants won’t tell you anything about how many suitable applicants you are attracting. But, it will tell you about the popularity of a role and how well you are marketing it.

Having too many candidates can show that your job description is too vague or the salary is too high. That’s why the number of applicants is a useful recruitment metric to track.

Industry benchmark: 118 applicants per position, on average.

Formula: Add together the total number of applicants from each source

5) Application Completion Rate

Definition: The difference between the total number of applicants vs. the number of qualified candidates who actually completed the application.

Why you should track it: To find out if your application process is encouraging qualified candidates to complete it or putting them off and causing them to drop out.

How many of those who start your application process end up submitting an application? If you have a large number of applicants failing to complete the application, there is a problem in there somewhere. Possible issues include:

The application process is too long or too complex

Technical problems (e.g. not optimized for mobiles)

Applicants asked for sensitive or irrelevant information

You can break this recruiting metric down by application stage to find if one has a larger quit rate.

Industry benchmark: 10.60%, according to Recruiter.com, but it’s best to aim for a higher completion rate whenever possible.

Formula: Application completion ratio (%) = (number of applications completed / number of applications started) x 100

6) Qualified Candidate Rate (Per Sourcing Channel)

Definition: The number of qualified candidates who applied for a position compared to the total number of people who applied for the job. You can further break it down per sourcing channel to find out how many of those qualified candidates came from which platform.

Why you should track it: Knowing how many applicants you have is often not enough. You need to know where your high-quality candidates are coming from.

If you get 100 candidates from a paid ad on a job board but only two of them are qualified, whereas you get 20 candidates through free social media advertising, and eight are qualified, you’ll have evidence that social media is a more effective tool. Knowing this could help you save a lot of money.

Having data that shows total applicants is more of a vanity metric — you want something that tells you about quality rather than quantity, which is why measuring your qualified candidate rate is helfpful.

If you find yourself with low numbers of qualified candidates, it can highlight many things, like:

The job description does not accurately detail the skills needed for the role

The job is being advertised through the wrong channels

The way the job is being advertised is attracting the wrong type of candidates

All these things are quite easily fixed with a few minor tweaks.

Industry benchmark: According to Workable, it depends on the location and industry. For example, it’s the lowest for healthcare roles (15) and highest for HR roles (63).

Formula: Qualified candidate rate (%) = (number of candidates who make it past the initial screening stage per sourcing channel / Total number of candidates per sourcing channel) X 100

SPEED AND COST METRICS

7) Cost Per Hire

Definition: The total costs of your recruitment efforts combined. From internal staff costs to job board fees, costs of screening and sourcing, all the way to the costs in time and money for each candidate interview.

Why you should track it: Knowing the cost of hiring a new employee is the basis for planning your recruiting budget. Most companies are calculating this recruiting metric, but few do it the right way.

To know how much you really pay for hiring a new employee, it is important to include all associated internal costs and external costs in the cost of hire. These include:

Advertising costs (job boards, social media ads, etc.)

Administration costs

Labor costs (time spent by recruitment staff from writing the job description to conducting interviews)

Candidate expenses

Background checks

Productivity losses incurred by post being vacant

Any other associated costs

If your cost per hire is high, look for ways to reduce it, such as by advertising through cheaper methods or by speeding up the pre-screening phase with cost-effective skills tests.

Industry benchmark: Depends on position and industry, but the average is around $4,700.

Formula: Cost per hire (€/month) = (Monthly internal recruiting costs + monthly external recruiting costs) / number of new hires per that month

8) Time to Hire

Definition: The amount of time it takes to get an employee on board. This includes everything from the time the job ad goes live until the time a suitable candidate is confirmed in the post.

You can measure this recruitment metric in a total number of days. If you want a more in-depth understanding, you can also break it down by:

The time between when a candidate first makes contact and when they are hired

The time it takes for the candidate to actually start the role

Average time to hire a number of different positions

Differences in time to hire between different positions

Why you should track it: This is a useful recruitment metric because it can help you identify if and when your hiring processes might be slow.

Avoiding slow hiring is important for two reasons. Firstly, it saves money in admin costs and prevents you from having unfilled vacancies for long periods. Secondly, it can help improve your candidate experience. Research has shown that candidates can be put off by lengthy application processes.

If your recruiting process isn’t the quickest right now, don’t worry, you’re not alone. Monese was faced with the same issue but managed to reduce their time to hire by 86%.

Industry benchmark: 36 days on average.

Formula: Time to hire (in days) = Day when candidate accepted the job offer – Day when candidate applied for a job

9) Time in Hiring Process Steps

Definition: A breakdown of the various stages that make up the total time to hire. Using your application tracking system (ATS), you should be able to see the amount of time spent by candidates in each of the hiring process steps.

Why you should track it: This is useful for identifying bottlenecks in the recruiting funnel. If your total time to hire is excessive, you can analyze the different steps to see where the problem is.

Industry benchmark: Depends on your industry, specific role, channel, and more.

Formula: Time in each hiring stage (days) = total number of days spent in the stage by all candidates / total number of candidates

10) Hiring Manager Feedback Speed

Definition: How quickly the hiring managers contact candidates after the interview. Ideally, this should occur within 2-3 days of the interview. Any longer risks losing the successful candidate or creating a bad impression of your company culture.

Why you should track it: The last thing you want is candidates chasing you up because they don’t want to be kept in limbo. This could impact the candidates’ experience scores. Tracking the feedback time and having a deadline will stop things getting out of hand.

Industry benchmark: 44% of candidates get feedback from the recruiting team within weeks of applying. 37% get it within one week.

Formula: Feedback speed (days) = total number of days to contact candidates after interview / total number of candidates

CANDIDATE EXPERIENCE METRICS

11) Candidate Experience (Candidate Net Promoter Score)

Definition: A score that tells you how much candidates like or dislike your hiring process.

Why you should track it: Candidate experience has grown in importance in recent years and is now a key part of recruitment analytics.

You can measure it through a satisfaction survey of all candidates. A common method is the Net Promoter Score.

Candidates are asked, “How likely are you to recommend this experience to a friend or colleague on a scale of 1-10?” then you subtract the percentage of 9-10 scores (promoters) from the percentage of 1-6 scores (detractors) to give you a total score between -100 and +100.

Industry benchmark: Aim for a value above 0.

Formula: Net Promoter Score = % Promoters – % Detractors

12) Candidate Response Rate

Definition: The number of candidates who follow up or respond to your attempts to contact them.

Why you should track it: If you’ve reached out to candidates through email, phone calls, etc., track how many responses you get. This can be measured as:

Number of candidates replying to an email

Number of candidates who follow up on an email and take the application to the next stage

Number of candidates who call back when you leave a voicemail

Number of candidates who follow up on a phone call and progress the application

You can use this recruitment metric to find the best channel to contact candidates. It can also be used to identify a poor recruiting pitch if hardly anyone is responding.

Industry benchmark: Anywhere from 30-50%.

Formula: Candidate response rate (%) = (number of responses / number of candidates contacted) x 100

13) Offer Acceptance Rate

Definition: The percentage of candidates who are offered a role that accepts the position.

Why you should track it: This recruiting metric can tell you valuable things about the overall success of your recruitment process as well as your candidate experience. If the acceptance rate is low, something’s going wrong along the line, and you need to rectify it.

Industry benchmark: Aim for a value higher than 90%.

Formula: Offer Acceptance Rate (%) = ( Number of Acceptances / Number of Offers ) x 100

14) Interview to Offer Ratio

Definition: The number of interviews you conduct for each hire that you make in your company.

Why you should track it: To keep track of your interview process. If you interview a large number of candidates for each job position, it means that your hiring process is ineffective.

Industry benchmark: You should be averaging about 1-3 interviews per hire. More than that, and you start to waste valuable resources.

Formula: Interview to offer ratio = total number of interviews / total number of offers

15) Candidate Withdrawal Reasons

Definition: The specific reasons why candidates pulled out of your recruiting process. Common reasons for withdrawal include too much travel, low salary, and better job offers elsewhere.

Why you should track it: Knowing why applicants quit can help you spot trends and improve your hiring processes. You can assess it with a questionnaire that has pre-selected responses to choose from to make it easier for the candidate.

Industry benchmark: This recruitment metric doesn’t have a benchmark.

Formula: Simply ask your candidates when they drop out, either using your hiring platform, a questionnaire, or an email

HIRING QUALITY

16) Quality of Hire

Definition: The overall value that a new hire brings to your organization.

Why you should track it: Reviewing the first-year performance of all new hires will let you know how well you are hiring top talent. It will also flag any under-performers.

The US Department of Labor calculates that bad hires can cost around 30 percent of the first-year salary. If your hiring practices are causing poor selection choices, you’ll see an increased cost per hire. Calculating the quality of hire depends on what factors make up a good employee for the post.

You’ll need to:

Decide on a few important factors (e.g. job performance score, cultural fit)

Give a score for each (e.g. 1-100)

Divide by the number of factors used to give an overall quality score.

Industry benchmark: There is no industry benchmark as you need to define your own factors for the quality of hire formula.

Formula: Decide on a quality of hire threshold score that equates to a good quality hire (e.g. 65/100). Then use this formula: Quality of hire score = (Job quality indicator 1 + job quality indicator 2 etc.) / # of job quality indicators

17) Internal vs. External Hires

Definition: The ratio of internal hires (promotions, lateral moves, transfers, moving temporary employees to full-time roles) to external hires that come from traditional sources.

Why you should track it: To measure the success of the recruitment process from internal and external candidates.

Many companies look to hire internally first as it’s cheaper, faster, and easier. But does it produce better results than external, data-driven hiring? Relying on internal hiring can limit development as fewer new perspectives are introduced. It also limits diversity.

Industry benchmark: This recruitment KPI doesn’t have an industry benchmark.

Formula: There is no specific formula, as it depends on what you’re measuring, e.g. hire cost, quality of hire, time to hire, etc.

18) Hiring Manager Satisfaction

Definition: A subjective measure of how satisfied the hiring managers are with the recruitment process and its different aspects.

Why you should track it: As well as the candidate’s experience, a good company should ensure high hiring manager satisfaction. If you’re filling positions, but the hiring manager isn’t satisfied, it could show problems, like not enough skilled candidates in the recruitment pipeline, which forces the hiring team to settle for less. It could also mean recruiter productivity is low or recruiting teams don’t have the resources needed to succeed.

Industry benchmark: Depends on the method you’re using to measure it.

Formula: Hiring manager satisfaction ratio = number of candidates interviewed / number of candidates the hiring manager is satisfied with

19) Adverse Impact

Definition: The negative effect of hiring candidates based on unfair and biased selection criteria. For example, choosing one candidate over the other because they are younger or went to a better university.

Why you should track it: Adverse impact skews the recruitment process. It means hiring managers select candidates they think are better but, in reality, produce a worse quality of hire. It not only leads to poor hiring decisions but can also end up in lawsuits as your company can discriminate against certain groups of the population.

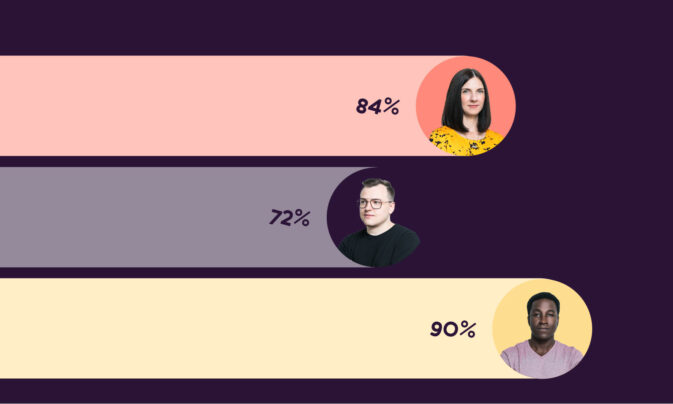

Industry benchmark: Anything more than 80%, according to the rule of four-fifths, is good.

Formula: Find the selection rate for each group. For each group, divide the number of applicants selected by the total number of applicants. Find the most favored group and the group that is least favored. For positive actions (e.g. hiring or promotion), the most favored group has the highest rate. For negative personnel actions (e.g. terminations), the most favored group has the lowest rate.

This is known as the four-fifths rule. Check out the below image for a further explanation.

EMPLOYEE METRICS

20) Employee Referrals

Definition: The number of candidates referred by existing employees of the company.

Why you should track it: This is useful in recruitment analytics, as studies show the benefits of hiring referred candidates.

For example, a Jobvite study found that employee referrals:

Have greater hire conversion rates

Produce faster hires (29 days compared to 39 for job boards and 55 for career sites)

Lower turnover rates, with 47 percent staying over 3 years

Industry benchmark: Depends on how long your business has been around. Companies that have existed for less than 20 years hire 30% of their employees through referrals.

Formula: Employee referrals (in terms of job candidates for a role) = (total number of applicants/number of applicants referred by employees) OR Employee referrals (in terms of those hired) = (total number of employees/number of employee referrals hired)

21) Employee Retention Rate

Definition: The percentage of employees who stay at your company over a specific period of time.

Why you should track it: Employees who stay for short periods of time influence your cost of hire. A low retention rate also indicates larger problems within your business that are making employees leave.

If you are experiencing high employee turnover, you’ll want to tackle the problem quickly. The problem could be with you as an employer, or it could be that you’re attracting less committed applicants to the role.

Industry benchmark: Aim for a value higher than 90%.

Formula: Employee retention rate (%) = [No. of employees at the end of a period / No. of employees at the start of a period] x 100

22) First-Year Attrition

Definition: The percentage of candidates who leave within their first year upon hiring.

Why you should track it: New hires should stay with you for as long as possible, and a year is a good breaking point to measure turnover or attrition. If candidates do not stay longer than a year, it shows low candidate job satisfaction. You may have internal issues, e.g. a misalignment between the job ad and what the job actually is about.

Industry benchmark: 37.9% of employees leave their organization within the first year of hiring. Aim for a number that is as low as possible.

Formula: (number of separations in a year / average number of employees in a year) x 100

23) Employee Attrition

Definition: The natural process that happens when employees leave the workplace. There are different types of employee attrition: due to retirement, personal reasons (i.e. finding a different role), relocation, internal attrition (moving to another department), etc.

Why you should track it: If employees are leaving you faster than you can find their replacements, this points to larger issues such as lack of space for growth, unprofessional work environment, poor work/life balance, and others.

Industry benchmark: Aim for a value lower than 10%.

Formula: (number of separations in a given time period / average number of employees in a given time period) x 100

Elizabeth is an experienced entrepreneur, writer, and content marketer. She has nine years of experience helping grow businesses, including two of her own, and shares Toggl's mission of challenging traditional beliefs about what building a successful business looks like.