Time tracking for accurate R&D record-keeping

Goodbye spreadsheets. Hello automation.

Claim up to $500,000 in R&D tax credits with accurate time tracking.

Important changes to R&D record-keeping in 2025

Companies can claim multiple expenses under the R&D tax credit, including:

Wages for U.S. employees who carry out research in your company

Research supplies such as computers, materials, and other equipment needed

Payments to organizations like educational or scientific bodies that assist with research

Contractor expenses when your company keeps the rights and information to the research results

However, the IRS has recently announced stricter reporting requirements for businesses claiming R&D tax credits. Any business eligible for R&D tax credits must now provide more specific and detailed records to avoid penalties — and maximize its offset claim.

Failing to meet the new reporting requirements could result in a reduced or rejected claim.

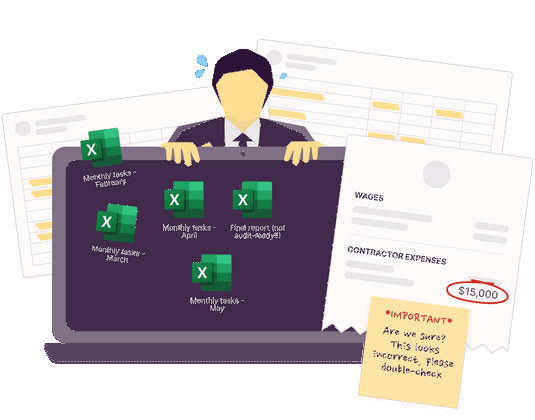

The Old Way

Ask employees and contractors to keep track of general tasks and activities in a spreadsheet

Gather everyone's spreadsheets, run calculations, and guesstimate any missing amounts

Submit generalized spending on resources, wages, and contractors

Offset up to $500,000 in R&D tax credits (but a lack of detailed reporting can prevent full claims)

The New Way

Track specific projects, tasks, and salaries that are eligible for R&D tax credits

Submit detailed breakdowns into how much time has been spent on qualifying R&D activities

Offset up to $500,000 in qualifying expenses thanks to accurate record-keeping

Spreadsheets are not enough.

With Toggl Track, businesses can keep accurate records and confidently claim every eligible R&D activity.

How Toggl Track can audit-proof your R&D record-keeping

Teams need detailed records to qualify for tax credits. Toggl Track automates R&D record-keeping — without the cost or complexity.

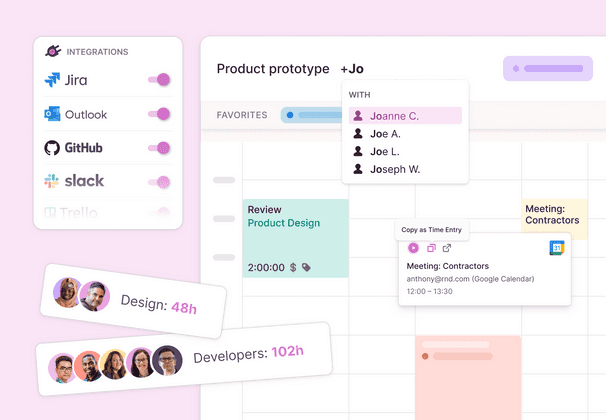

Make it easy for your team to track time for R&D tax credit-eligible projects and tasks.

R&D tax credits will be denied with incomplete information about activity hours. With custom onboarding and training, your team will be ready to track time accurately from Day 1.

Ask us about custom onboarding

“The acceptance from all users is very high. I have seen a 40+ year employee move from their Excel-based tracking they have used forever, to this tool without any issue.”

— Software Lead. 5/5 stars on G2.com

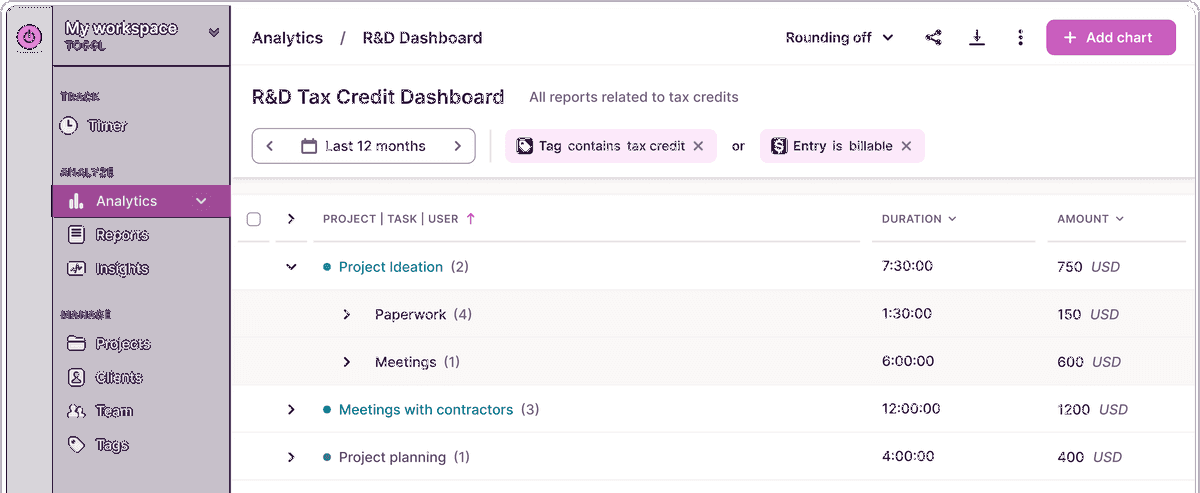

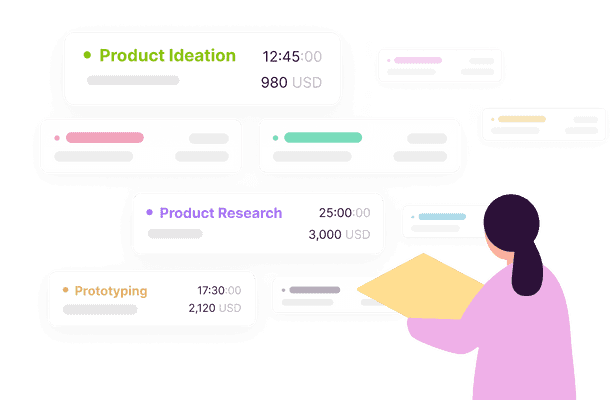

Customizable tags for projects

Add custom tags to unlimited projects and tasks to capture the information required for Form 6765.

Use this segmented information to fill out Section G of the updated IRS form quickly and accurately.

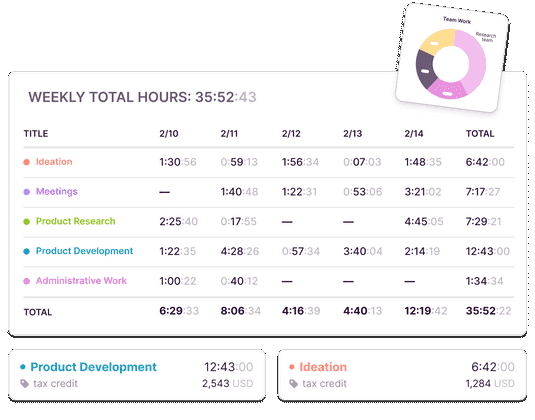

Automated time tracking for QRA and QRE data

Use our intuitive apps that work in the lab, remote, or on the go.

Our mobile and desktop apps can effortlessly track time spent on activities and store the data in your Toggl Track workspace.

Security-first data collection

Add required fields to time entries to maximize accuracy when it’s time to file.

Use Toggl Track audit logs and locked time entries to ensure data integrity if the IRS conducts an audit.

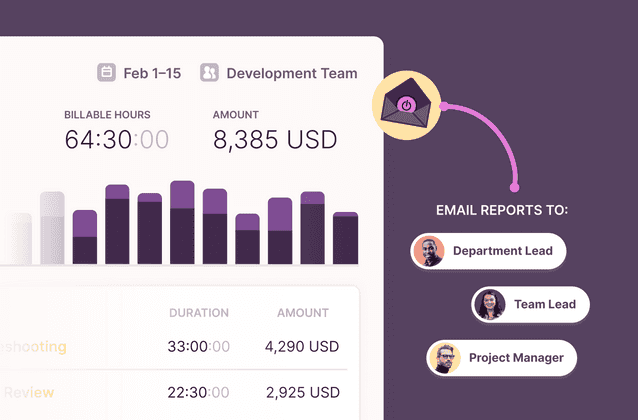

Audit-ready reports for your accountants

Generate comprehensive reports that break down time spent on projects, team members, and activities.

Send audit-ready reports straight to your accounting team.

“Toggl Track helps me keep my reports in a way that's easy for me to compile and easy for our accountant to read. It also lets me run reports with a wide range of customized date ranges (monthly, quarterly, weekly, daily, etc).”

— 5/5 stars review on G2.com

Don't leave your R&D tax credits on the table.

The IRS requires companies to document expenses as they happen, rather than retrospectively record how much time and money were spent on activities.

Toggl Track is an IRS-ready time tracking solution for businesses to document every activity in detail — without clunky spreadsheets or expensive software.

Speak to one of our sales reps to see how our time tracking solution can simplify your R&D record-keeping.

Learn how to integrate Toggl Track into your team's workflow to get everyone tracking time

Discuss custom integration and reporting solutions we can build for your team

Get your team onboarded and trained with a Customer Success Manager

Explore volume pricing discounts available for medium to large-sized teams